Kelly Criterion Football

Go Back

The Kelly Criterion Explained. Football fans who are determined to broaden their horizons, and to make their betting session even more bountiful might be keen on learning more about the Kelly Criterion. In essence, this betting method is applicable to almost all forms of gambling, including wagering on soccer. Other than that, it is utilized while making investments due to the fact that it is the perfect tool. Kelly Criterion. The Kelly Criterion method. Here we look at a trading strategy that was developed to.

Kelly's Criterion - Understanding - Part 2

Posted on July 23, 2018

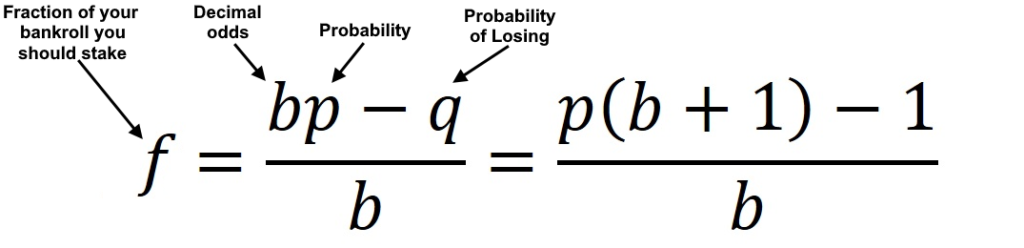

Defining and deriving Kelly's criterion in Part 1 was an important exercise in order to understand the underlying mechanisms of the formula so we can apply it correctly.

We will now focus on understanding and applying Kelly's Criterion starting from a basic coin toss examples up to a soccer betting example.

1. Suppose we have a fair coin ($p=q=0.5$) and even pay-off, that is we win 1 unit if the coin lands Heads and lose 1 unit if the coin lands Tails.

Let our random variable $X$ be the number of heads obtained after $n = $ 5 tosses. The expected value of heads obtained is,

$begin{align*} E[X] & = 1 cdot 0.5 + 1 cdot 0.5 + 1 cdot 0.5 + 1 cdot 0.5 + cdot 0.5 & = 5 cdot 0.5 & = 2.5 end{align*}$

Therefore the expected number of heads to land after 5 tosses is 2.5.

Now we want to calculate the expected value of our winnings. This is also a random variable that we will define as $W$ (why is it a random variable? Left as exercise) and is a function of $X$ (depends on how many Heads or Tails ($=$ not Heads) land!).

$begin{align*} E[W] = E[f(X]] & = E[1 cdot X - 1 cdot (5 - X)] & = E[2X - 5] & = 2 cdot E[X] - 5 & = 2 cdot 2.5 - 5 & = 0 end{align*}$

The expected value is 0, and rightfully so since our coin is fair and our pay-off is even. Consider this example as a warm-up for the examples to come. If you are not comfortable with the mathematical concepts presented above, I would recommend looking into one of the excellent resources I have shared at the bottom of this post. A page & exercise a day from any of these books will get you up to speed in no time with the mathematical and probability concepts presented above.

What does Kelly have to say about this example? We slightly re-word the example above by adding an initial capital, call it $X_0$, of 100 units. Kelly proposes betting a fraction of your wealth in order to maximize the expected increase in wealth after every toss.

From Part 1, we already worked out a game of chance with even pay-off. Our wealth after 5 tosses would look like the following

$begin{align*} X_5 = X_0(1+f)^H (1-f)^T quadquad text{H for Heads, T for Tails} end{align*}$

where $f^* = p-q = 0$ is the fraction of our wealth that maximizes the expected value in increase of wealth defined as $frac{H}{5}log (1+f) + frac{T}{5} log(1-f)$.

Lets compute the expected value of increase of our wealth maximized by $f^*$

$begin{align*} & E[frac{H}{5}log (1+f^*) + frac{T}{5} log(1-f^*)] & = 0.5 cdot log (1) + 0.5 cdot log (1) & = 0 end{align*}$

Kelly suggests not betting on each coin toss and our expected value of increase of our wealth is 0. Rightfully so because we do not have an edge, and Kelly wants an edge!

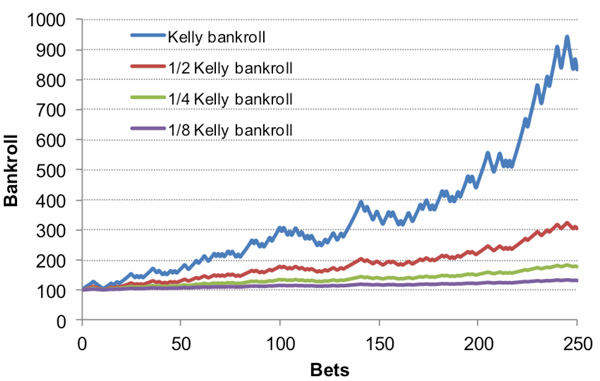

Now lets suppose we have analyzed the historic performance of this coin and have determined with great confidence that the probability of winning (obtaining Heads) is 60% after 5 tosses. Now $f^* = 0.6 - 0.4 = 0.2$ That is, in order to maximize our expected value of increase of our wealth in each trial we must bet 20% of our wealth. The expected value of increase of our wealth after each trial, maximized by $f^*$, would be

$begin{align*} & E[frac{H}{5}log (1+f^*) + frac{T}{5} log(1-f^*)] & = 0.6 cdot log (1.2) + 0.4 cdot log (0.8) & = 0.00874474242 & approx 0.87% end{align*}$

So after 5 successive bets on Heads the log average of our wealth is expected to be $0.0087cdot 5$ times bigger than our initial capital. That is, after 5 tosses betting 20% of our wealth on Heads our final wealth is expected to be on average $e^{0.00874474242 * 5} = 1.04469367879$ times bigger than our initial wealth, that is $X_5 = 100 * 1.04469367879 approx 104.47$

Lets remember that our increase of wealth after each trial was equal to $log (frac{X_n}{X_0})^frac{1}{n}$. This was derived in Part 1

Kelly Criterion Football

This concludes Part 2. Hopefully this basic example has provided further insight into the mechanics of Kelly's Criterion. In Part 3 we will step up our example with an uneven-payoff and finally finish with an example applied to soccer betting. Hopefully it is becoming clearer that the final formula of Kelly's Criterion that we are all exposed to is only the tip of the iceberg of the concepts and definitions that give rise to it. Correctly applying it is only possible if we understand it.